What does FICO in SAP FICO stand for?

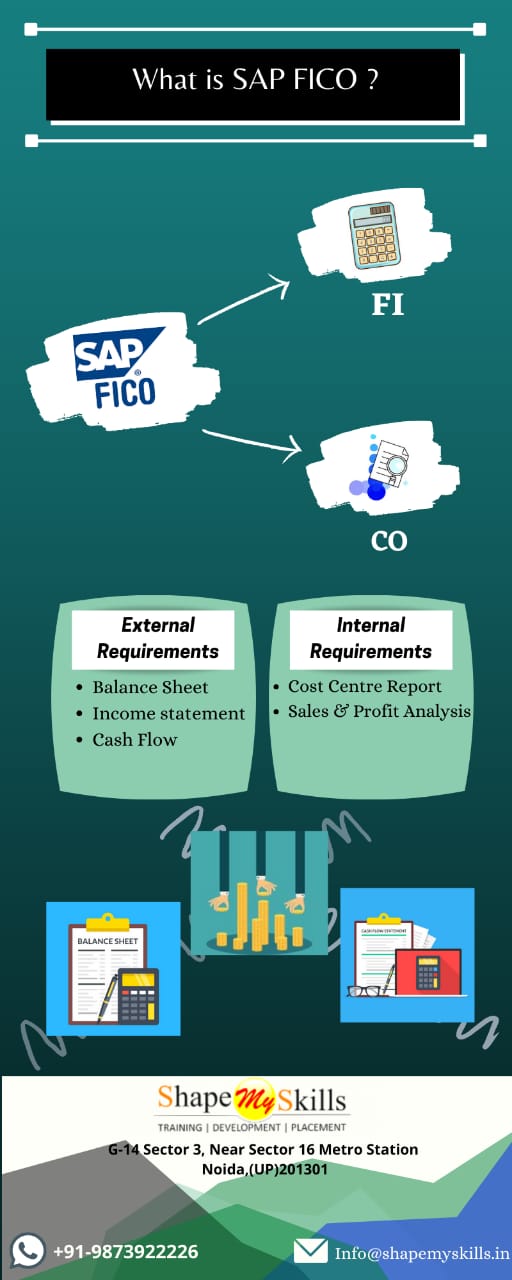

In SAP ERP (Enterprise Resource Planning) SAP FICO is one of the essential modules where FI stands for financial accounting and CO stands for Controlling. SAP FICO permits a company for managing all financial data. SAP FICO permits the company for storing financial transaction data. The main aim of SAP FICO is to help the organizations for generating and managing the financial statements for reporting and analysis as well as for helping in efficient decision making and business planning.

In this blog, we are discussing the SAP FICO module, the best SAP ERP component. There is a huge demand for individuals having done SAP FICO courses from the best SAP training institute. There are many institutes for SAP FICO Training in Delhi NCR so you have to select the institute wisely. ShapeMySkills Pvt. Ltd is the best SAP FICO Training in Noida and it provides both online and offline classes to its students as per their suitability. They provide various facilities to their students and also give a certificate of relevant courses after completion of training.

SAP FICO containing 2 sections i.e. SAP Finance (FI) and SAP CO (Controlling) and each of them is used for the financial process. SAP FI is dealing with overall financial accounting and reporting and on the other hand, SAP CO is focused on monitoring and planning the cost. They are both separate modules but now they are integrated as one module. SAP FICO is fully integrated with other modules such as Materials Management (MM), Quality Management (QM), Sales and Distribution (SD), Plant Maintenance (PM), Production Planning (PP), etc.

SAP FICO Sub-Modules

There are various sub-modules of SAP FICO and all these are integrated and interlinked in real-time. In the below section, we explain sub-modules of both SAP FI and SAP CO separately. Check Now!!!

SAP FI Sub-Modules

SAP FI enables the companies for making financial statements to report and analyze. Financial statements types include profit & loss and balance sheet statements. SAP FI contains various sub-modules that handling the accounting process:

- General ledger accounting: it contains all organization transaction data in the accounts chart. In this system, the list consists of all accounts. In real-time, Transactions are recorded in sub-modules with general ledger data. These accounts are used for preparing all financial statements. Transactions that are done directly in general ledger accounting include journal vouchers and that is a post for adjusting or correcting the transactions.

- Account Receivable: it captures the transactions of customers and manages the accounts of customers. Customer’s accounts will be maintained separately and when transactions are posted in reconciliation accounts, customer accounts in the General ledger updated within real-time figures. These transactions include credit memo posting, invoice posting, down payments, executing customer reports or invoice payments.

- Accounts Payable: it captures the transactions with vendors and also manages the accounts of the vendor. Vendor accounts are maintained separately and when transactions are posted in accounts of customers, reconciliation accounts in the general ledger are updated within real-time figures. Transactions in accounts payable include down payments, automatic payment program, implementing vendor report, credit memo posting, invoice posting, invoice payment, etc.

- Asset Accounting: It manages all transactions regarding organization fixed assets that include building, land, and heavy equipment. Transactions included sales, transfers, asset acquisitions, retirement, depreciation, and revaluations.

- Bank Ledger: It is dealing with all organization’s bank account transactions and data. It may reconcile all transactions that record on the statement of the bank and compare it with the transaction in the system.

- Consolidation: It enables the organization for combining financial statements for various entities that provide a company’s financial position overview.

- Funds Management: it manages the company revenue and expenses budgets.

- Special Purpose Ledger: In SAP FI, it defines the ledger for reporting purpose.

- Travel Management: It manages all transaction data related to travel-related expenses such as booking trips etc.

SAP CO Sub-modules

SAP FI is dealing with organization accounting and external & internal reporting whereas SAP CO supports the process of planning, reporting, and monitoring the cost of business operations. SAP CO is instrumental to enhance the profitability of the company. There are various sub-modules of SAP CO that handling the specific process:

- Cost Centers: it is dealing with costs that associate with the organization’s internal divisions or depts like production, sales, HR, and marketing. It only involves expenses not revenues.

- Cost Elements: It offers an overview of all organization costs and revenues based on P & L statements. It describes the cost origin and it also represents a specific cost that organization incurs.

- Profit Centers: It is handling all data of cost regarding organization business lines. It is dealing with revenues and expenses such as Cost Centers that deal only with expenses.

- Internal Orders: it is used for managing the cost for smaller internal projects or non-fixed assets such as limited-time marketing campaigns.

- Profitability Analysis: it enables the organization to analyze the profitability of its products. It permits the level of information to analyze the profitability.

- Product Costing: it manages the data regarding the cost that is needed for producing company goods and services. Its analysis helps for managing manufacturing cost and optimizing the efficiencies.

So, guys, this is all about the SAP FICO, the most important sub-module of SAP and it deals with all financial transactions data-related roles. Hope you understand it. Many companies already use SAP FICO and many companies are starting to adopt it. Those who want to get SAP FICO training in Delhi NCR are advised to choose the SAP training institute wisely.